Single sign-on isn’t rocket science in fintech. If anything it’s common and almost expected nowadays. But it’s the first thing we think about when we search for and build new technology at Carson. And here’s why. Single sign-on aligns with our focus to partner with the best-in-class technology that can deliver a stellar client experience.

Other portals focus on the details and get into the weeds, going so far as to show clients how a specific security performed on a specific day at a specific time. That’s a one-click-away feature on our portal rather than our focus. Here are a few of my other favorite parts of our new client experience (which you can see by requesting a demo here):

1. The 30,000-Foot Fly-by and the Deep Dive

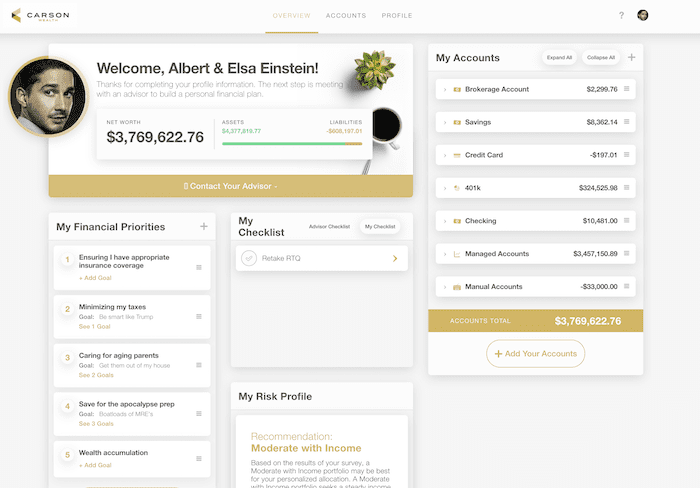

Our first goal with our client experience is to provide a total net worth picture per client. We know clients don’t want to (or have the time to) sift through account details. When they sign on to their account, they have a goal to confirm their assets are there. I call it the “30,000-Foot View Fly-By.”

Think about the last vacation you took. When you returned home, how did you feel about the money you spent? The main question people are asking themselves is, “Did I spend more money than I have?” So you sign on to your banking account see your total amounts, confirm your money is safe and move on with your day.

People might spend time reviewing specific transactions, but the overall goal is to keep track of total assets. Our new client experience portal begins there, and then allows your clients to dive deeper. On first glance, clients see what’s at the top of their minds – current assets – but there’s so much more to see beyond that.

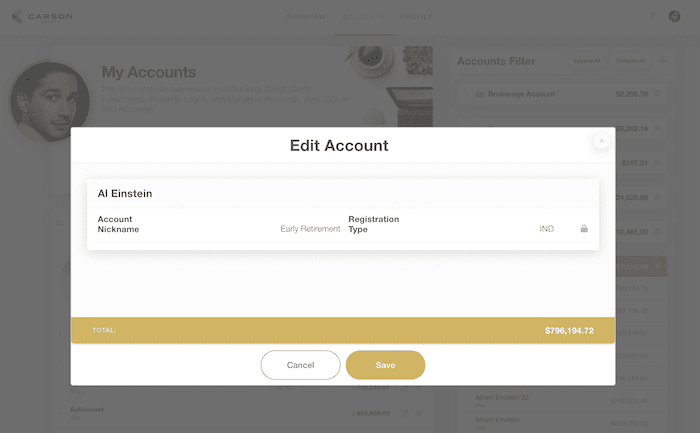

We wanted to create an accurate picture of their total net worth. All data from all accounts is in one place – with the ability to link to outside accounts like checking, credit cards, etc. You can also view different strategies. One of my favorite features in this section of our portal is the ability to nickname account types. Instead of “IRA” or other three-letter acronyms, clients can name the account based on their endgame.

Maybe they’re using an account to save for retirement or to pay for a beach house. This helps tie in the behavioral aspect of money – driving home the whole net worth picture.

2. Open Communication Lines

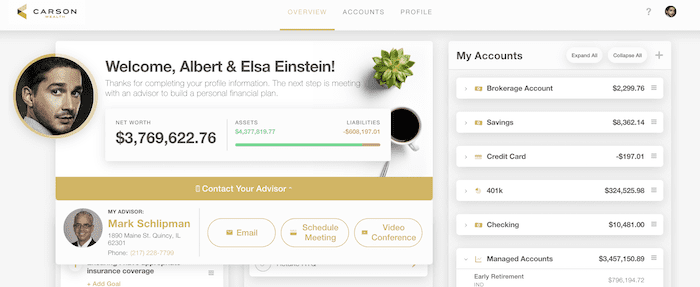

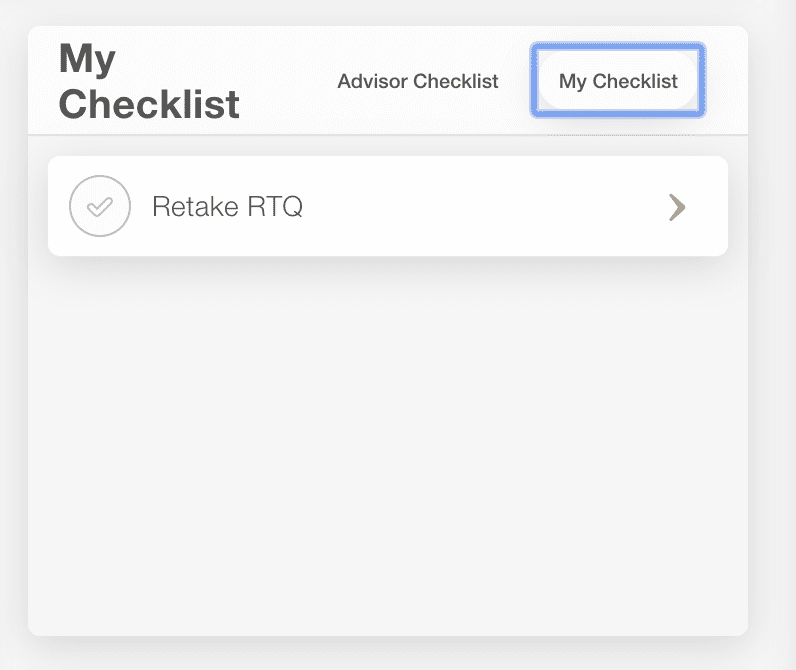

The second goal of our client experience portal is opening communication lines between you and your clients. Specific tasks and goals can be tracked according to individual clients and then tracked in your CRM. In our portal, clients have access to both their own financial goals, as well as checklist task items assigned by the advisor (e.g., linking certain accounts). You can also choose to display your own tasks you’re currently working on for that client to increase transparency.

Our integrated approach allows clients to schedule a calendar video meeting via Calendly based on time parameters you set. This nixes the need to send links back and forth. A client can access and launch the video conference directly inside the portal.

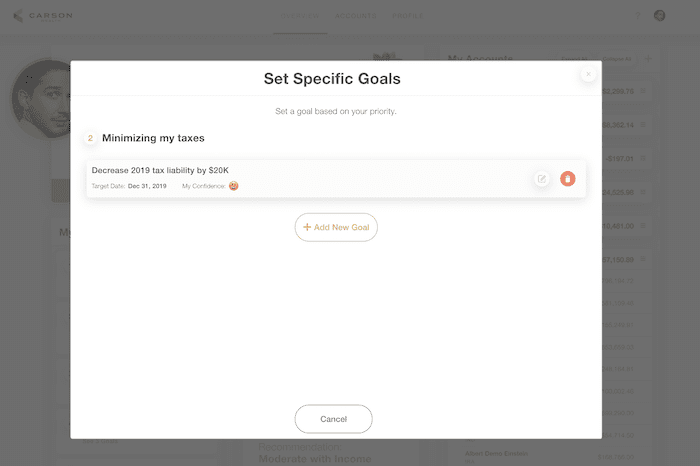

3. Focus on Planning, not Management

The third goal of our client experience portal is to take the focus away from investment management and put it on helping clients meet their goals. Our client portal highlights behavior-based goals such as saving for retirement or providing a legacy for their family. Clients can add in financial priorities with a timeline and how confident they feel about completing it.

This new client portal has been 18 months in the making, and every decision we made along the way was focused on creating a more open relationship between advisor and client and a simpler relationship between a client and their money. Fintech is an ever-changing realm. New solutions come on the map everyday and it can be a time-consuming process to test and select an effective solution that’ll last.

At Carson, we partner with the best solutions to drive the best client experience for you and your team in supporting your clients. Want to see our client experience up close and personal? Click below.