Much is said in our profession—especially lately with the changes implemented by the DoL amendment of the definition of fiduciary—about the difference between advisors.

The distinction between commissioned, fee-based and fee-only is one of importance both to investors and advisors. Being clear on what service you provide, how you provide it, and how your clients benefit will help you position your firm and provide an optimal investment experience for your clients.

What Financial Advisor Type is Best?

As a hybrid Registered Investment Advisor (RIA), we set our partner advisors up with the ability to provide personalized solutions for their clients’ needs. Financial life planning-based and fee-only wealth managers tend to be those most drawn to our Turnkey Integrated Partnership. However, some financial advisors think that they are one type of advisor when in reality, they are something else. Do you know what type of financial advisor you really are, and what it means for your practice and clients?

|

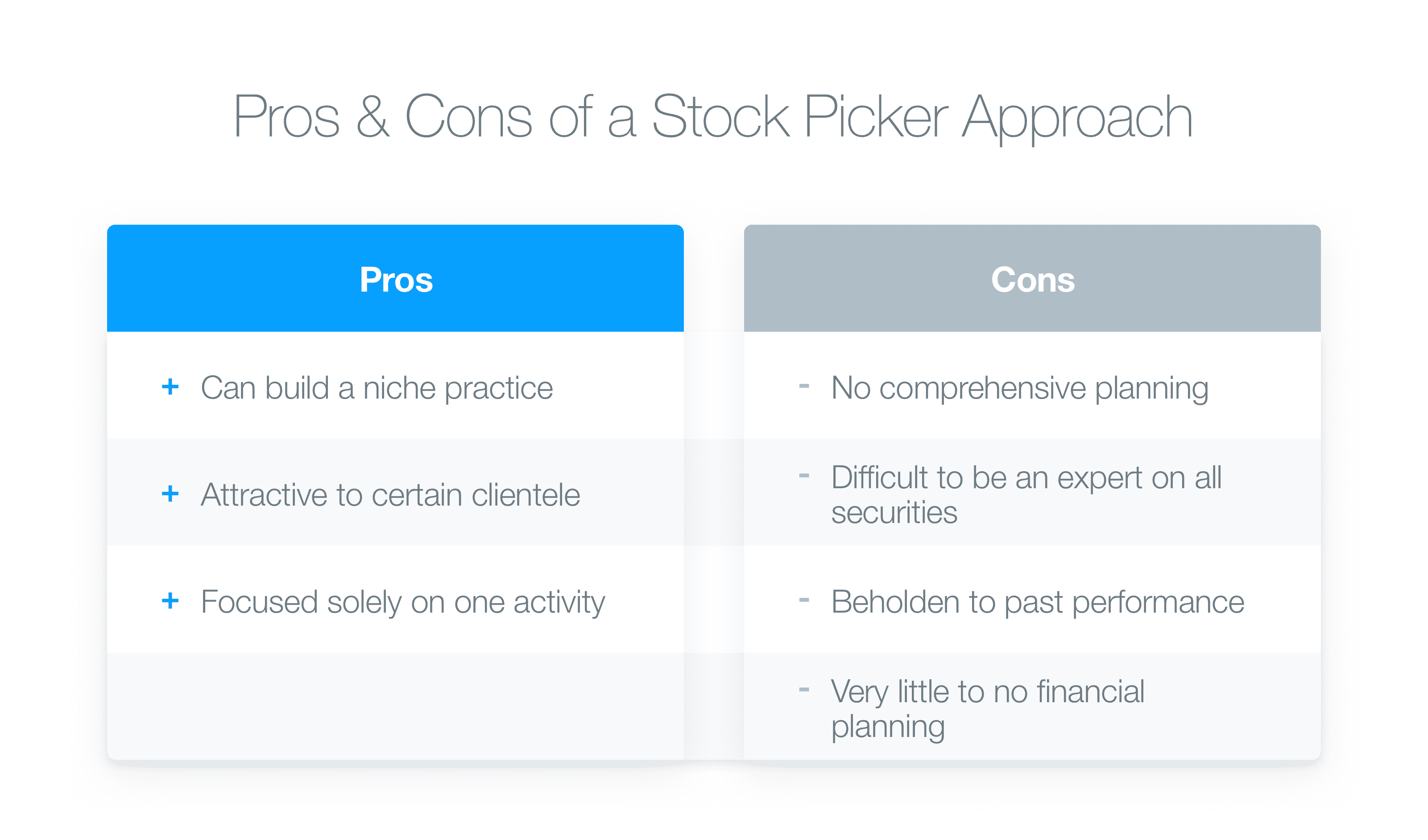

The Asset Manager (aka Stock Picker) |

Asset Managers build portfolios of individual securities for clients and focus exclusively on managing assets. They desire to be valued solely on their investment performance and closely identify with their skill in managing assets and building portfolios. They are typically the least comprehensive in terms of services offered to clients, as their greatest focus is on building investments.

|

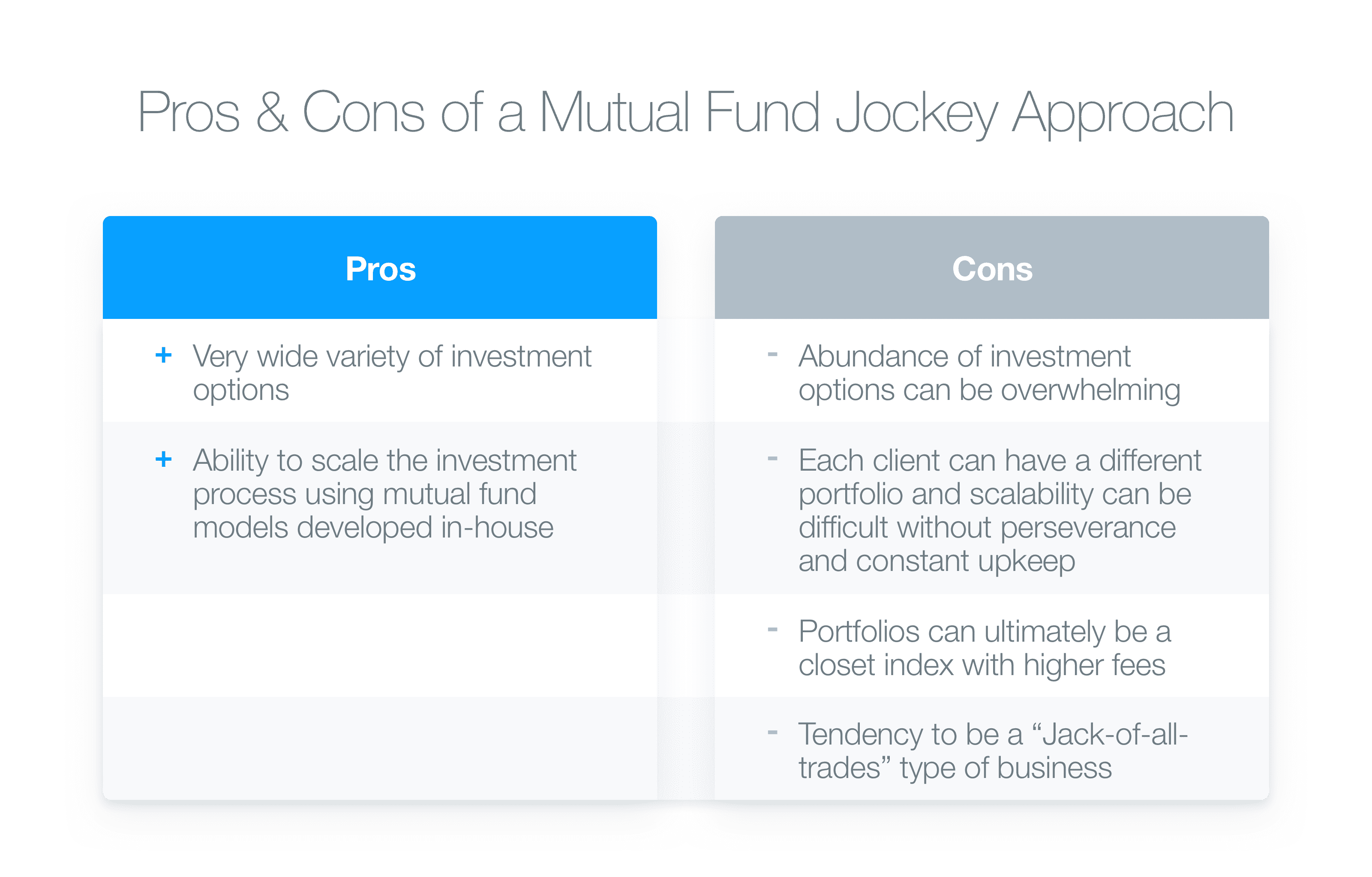

The Financial Planner (aka Mutual Fund Jockey) |

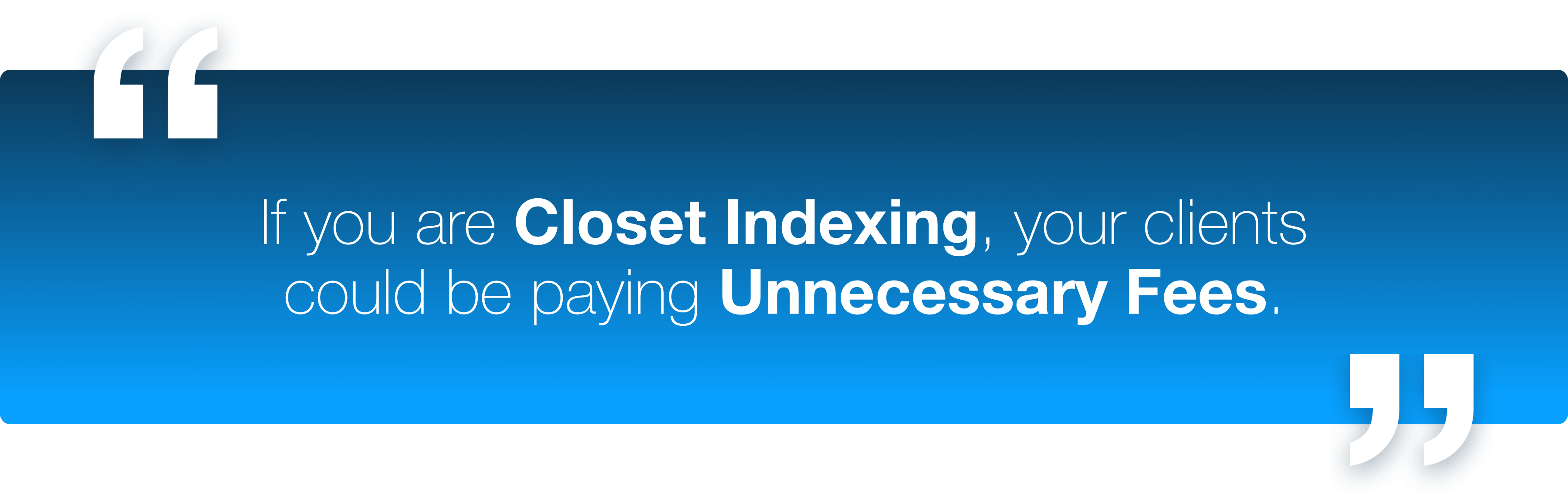

Financial Planners emphasize asset management as the primary service, but typically stick to mutual funds for portfolio building. For this reason, they may be branded as Mutual Fund Jockeys. They may work with investors with larger financial needs on an as-needed basis and offer modular services such as retirement planning or education funding. Typical planners often strive to deliver comprehensive financial advice, but many clients—especially those with complex financial scenarios—do not receive comprehensive financial plans due to limiting factors of the individual advisor. Closet indexing is the practice of closely following an index in terms of weighting, industry sector or geography. Mutual Fund Jockeys may fall into the trap of becoming closet indexers in order to cater to clients’ or others’ expectations about investment performance matching the benchmark.

|

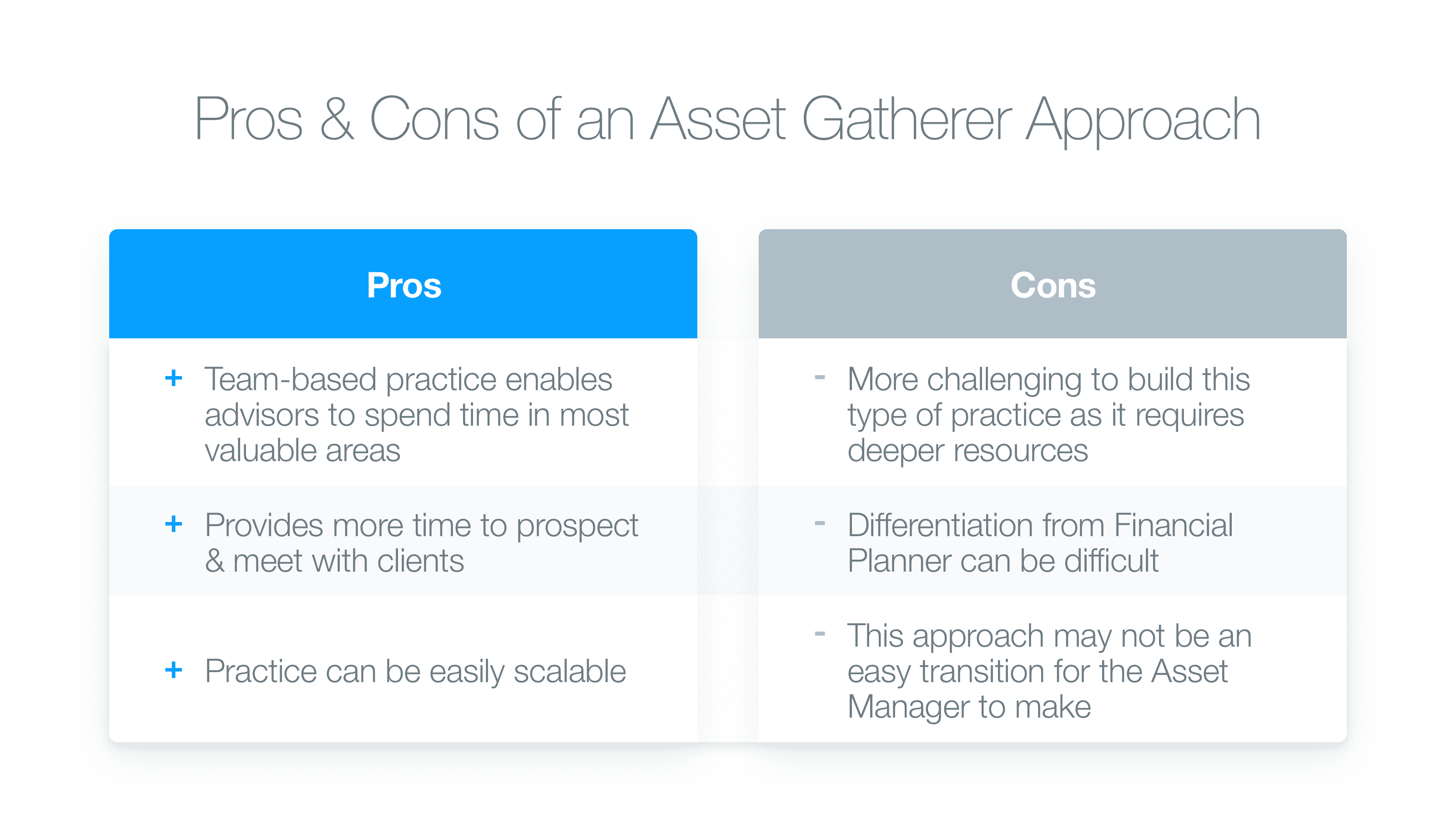

The Wealth Manager (aka Asset Gatherer) |

Wealth Managers specialize in comprehensive wealth management and transfer issues including stock-option planning, executive compensation, complex trust and estate planning, and charitable giving. They provide additional services to meet the wider needs of high net worth individuals, including philanthropic giving and concierge-type services. Wealth managers are not overly tied to picking stocks or handling investment management themselves–acting as a gatherer of a selection of investment options, rather than a picker of any one specific investment–they have a more holistic view of managing their clients’ financial lives and will “gather” the right tools, assets, and resources to help them do so.

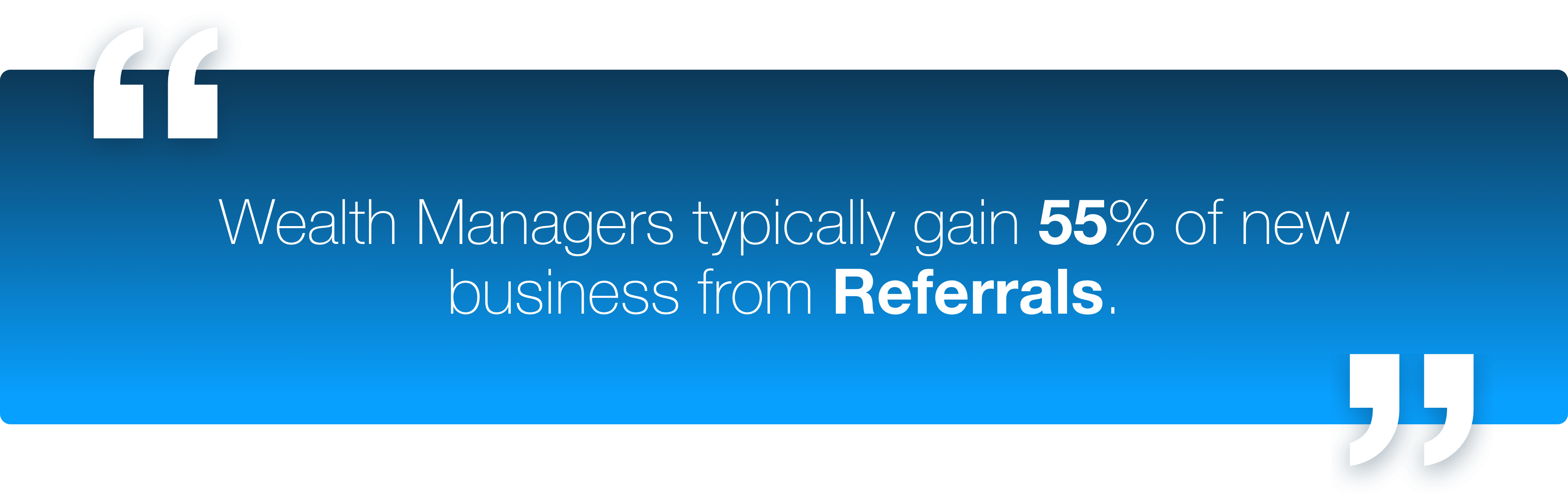

Wealth managers tend to work in team practices and provide either in- or out-house resources for the specialized and more sophisticated services that they provide (e.g., advanced planning and wealth preservation)* They often have fewer clients with larger amounts of assets and are more likely to get referrals – from either clients or other professionals.

What kind of advisor do your clients think you are?

Perhaps the most important question to ask is not what kind of advisor you think you are, but what kind of advisor your clients think you are. I personally think the majority of advisors are either stock pickers or mutual fund jockeys. This may be ok for now—but honestly I think the balance is starting to shift and will continue to shift toward more wealth managers in the future—if it serves the client’s best interests. But where I think it is dangerous for both advisor and client is when an advisor views (or portrays) him or herself as one type of advisor when in reality he or she is practicing as another. At the end of the day, the reason it’s important to accurately understand what type of financial advisor you are is so that you can grow your business and serve your clients appropriately. If you bill yourself as a wealth manager but are only providing stock picker service, your clients will know the disconnect and it could ultimately affect your business.

The client investment experience is more important now than it ever has been. Change is already happening—and will continue to accelerate—in our profession. If you are selling clients based on your ability to pick stocks or a particular fund’s performance, like it or not, at some point you may lose clients. If you don’t have a solid, clearly articulated value proposition of what you do for your clients, at some point you may lose clients. You must understand the “why” behind your financial services firm in order to implement the “how” of delivering that service to clients, and then deliver your services consistently.

Learn more about delivering a personalized investment experience could help you grow your business and better serve your clients by joining us for a free webinar, Be Better Than Average: Give Your Clients a Personalized Investment Experience

Do you find a disconnect between the type of client experience you are providing and what your clients expect? How have your clients’ and prospects’ expectations shifted over the past five years? How has this impacted your practice? Tweet using the hashtag #ServeMyClients to share your thoughts or questions on client investment experience and connect with our team.

For advisor use only. Not intended for public distribution.