This post is part of a series discussing the findings of the 2022 State of Women in Wealth Management Report by Mary Kate Gulick and Julie Ragatz, Ph.D. The 2022 study is based on survey data and interview input from a wide selection of cross-channel financial advisors.

While getting women into financial advice roles is often the primary concern, the understanding of how to retain women in wealth management is just as important.

The barriers listed previously – work-life balance, finding a mentor, finding a firm that’s a culture fit, discrimination – were not barriers to entering the profession. Rather, they were barriers to success for those who have already started their career.

Each of these barriers represents a factor that can increase retention risk. Beyond the barriers listed, a perception that women advance at a slower rate to their male counterparts also creates retention risk.

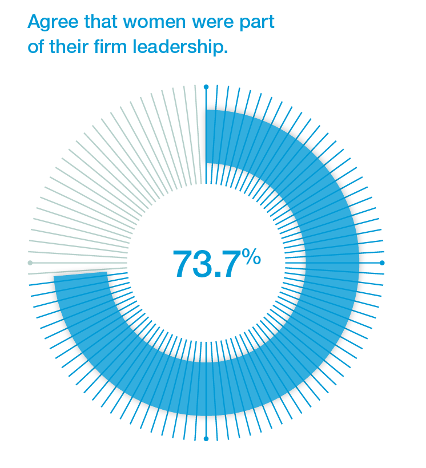

For women in wealth management, critical evidence of access to advancement comes in the form of existing women in leadership. Nearly three-quarters of respondents (73.65%) said that women were part of their firm leadership, with very little difference reported by men and women. While the survey responses indicate the presence of women in leadership, the comments indicate that there are few.

“There are so few women to look up to that we often need to pave the way.” – Survey Respondent

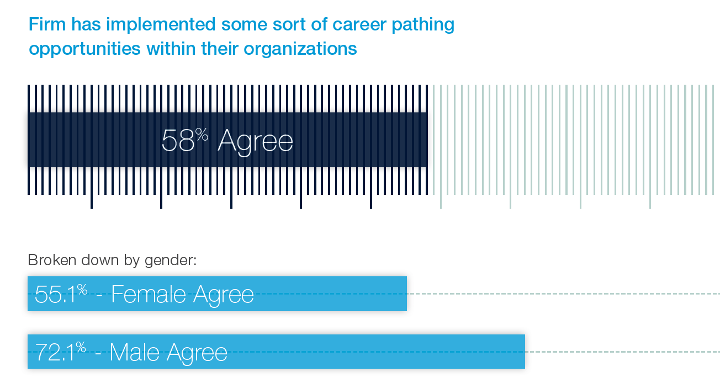

Intentional career pathing within firms can help ensure visible opportunity for all firm employees – men, women, advisor and operational. The firms of 58% of the respondents have implemented some sort of career pathing opportunities within their organizations.

When that number is broken down by how each gender sees it, however, 55.1% of women believe this is true, compared to 72.1% of men. Career pathing and thinking through intentional advancement for all firm employees is a positive step forward.

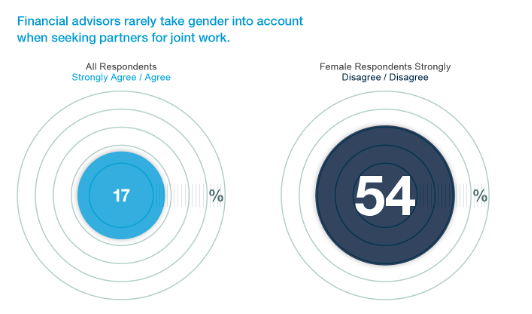

A more troubling finding concerns the perception among female advisors that their gender plays a role in receiving offers for joint work with other advisors, a factor in long-term advancement. In response to the statement “Financial advisors rarely take gender into account when seeking partners for joint work,” only 17% of all respondents strongly agreed or agreed, and over half of female respondents (54%) either strongly disagreed or disagreed.

Females were significantly more pessimistic than male advisors. This may also indicate a belief that male advisors don’t often see female advisors as a viable option upon transitioning their book of business.

When Women Feel Welcomed, Accepted and Appreciated

The first part of each interview included a discussion about what caused women to stay in the industry and helped them to thrive.

What is immediately obvious in the conversations is that it was often the small, but intentional, choices of the firm that meant the most. Most women shared stories about being included in meetings, being assigned major projects and empowered to take on more responsibility. Often, this direction comes from male superiors and colleagues.

Women feel accepted and appreciated when they are seen as a trusted resource within their office, when they feel as though their voices are heard and respected, and when others advocate on their behalf.

Women were proud to be recommended for educational opportunities, recognized through industry awards and nominated to be part of industry study groups. Other factors were more subtle. Women feel accepted and appreciated when they are seen as a trusted resource within their office, when they feel as though their voices are heard and respected, and when others advocate on their behalf. Importantly, women feel accepted and appreciated when they are believed and supported when others behave inappropriately.

When Women Feel Unwelcome, Unaccepted and Unappreciated

While the survey did not specifically mention harassment, hostile work environment or assault, it came up often during the interviews as one of the primary reasons women choose to leave the profession before they’ve achieved the success they want. From demeaning language in the office to inappropriate physical advances, nearly every female interviewee had a story to share.

Multiple women shared being mistaken for the assistant, and often treated as one even when her role was clarified. One woman was told by a male superior that becoming an advisor was a “bad move” for a working mom, discouraging her from even joining the industry.

Other women said they received discouraging remarks about their physical appearance or clothing. One respondent was told she would never make it because she was not pretty enough. Another was called an inappropriate name when it was her turn to speak in her study group, prompting laughter from other men.

Another recurring response highlighted the importance of safety for women at events. The general rule shared repeatedly in the interviews is that if an event involves alcohol, women did not feel safe to stay past 9 p.m. Some women said they skip events after dinner as a general rule, seeing this as a loss of important networking time, but required for their safety.

I was at a meeting with all the management team and I said, “Hey, guys. Great, great day. I’m going to go up to my room.” Someone I knew as an acquaintance followed me into the elevator…all of a sudden, I feel my hair being stroked and pulled at. And when the elevator doors opened, he grabbed my arm and tried to pull me out onto the floor. That was appalling. I had to work with this person every day, and I never felt seen as an equal because he felt that he could do something like that.

The prevalence of such experiences underscores why many women simply don’t feel appreciated or accepted working in wealth management.

So, what do we do?

The women surveyed had plenty of thoughts on how to ensure more welcoming and accepting work cultures where women feel appreciated.

Flexibility

Respondents want to come and go as they please, and work from the most convenient location. Women in particular, due to their disproportionate family responsibilities, prize workplace flexibility more than ever. Firms should allow all advisors to choose how to spend their time and emphasize outcomes over time at a desk. Allow teams to schedule their weeks with respect to their personal commitments. Provide tech support (even if it’s an outsourced service) to those who work remotely or a hybrid schedule.

It is important to note that women are not asking for fewer hours. They clearly understand the need to work hard and work long, but they are looking for the opportunity to determine when they work those hours.

Education and training support

Firms often bristle at the mention of training and education because their first reaction is that they’ll need to do the teaching. What respondents really want is support (financial and time) for their certification courses, tuition reimbursement and professional development at conferences to grow their social networks and expertise. The good news is that this training makes each advisor, and thereby the firm, stronger performers.

Career pathing

In the fervor to recruit female advisors, firms often overlook a high-potential candidate pool right under their noses. Operations professionals – client services, back-office support, human resources – know your culture. They know your clients! Does your firm have an operations-to-advisor career track? Do your non-advisor team members know that becoming an advisor is even an option? This type of career pathing can help ensure that new advisors are culture fits (they’re tried and true, after all), and can speed up the onboarding time that’s associated with an outside hire.

Mentorship opportunities

Difficulty finding a mentor was one of the often-cited barriers for female respondents. While it’s difficult for small firms to set up mentorship programs, firms can take advantage of other networks of women in wealth management (WIFS, Females & Finance) and pay for memberships. This allows advisors to grow their social networks, find role models and mentors, and get a better sense of the career possibilities available to them.

Enforcing zero-tolerance policies

Both in offices and industry conferences, guidelines for behavior should be clearly spelled out and swiftly enforced. When a boilerplate policy is put into effect for the sake of optics, then not enforced when policies are broken, it sets a precedent for the organization and sends the message that the safety of female colleagues does not matter. Setting a policy is not enough. Enforcement steps that are followed fairly and consistently applied are what matter most.